Norfolk Southern: Rail Labor Shortage Crisis Will Continue To Hamper Profit Margins

Summary

- The labor shortage among railroad workers presents a significant bottleneck in the broader supply-chain crunch since 2020.

- Railroad strike efforts in 2022 and the recent Ohio derailment disaster have further strained labor satisfaction deficits in the industry and are likely increasing attrition.

- Most rail employees are near retirement age, with very few trainees under 30 years old, meaning the labor shortage could grow over a prolonged period without substantial improvement.

- Norfolk Southern’s sales may decline in 2023 as the manufacturing PMI signals a more significant contraction in US rail traffic.

- Over the coming years, I suspect Norfolk’s margins may decline by 5-10% as the company grapples with rising costs and stagnating revenue.

Wirestock/iStock Editorial via Getty Images

The railroad industry has been in the headlines over the past year for various reasons. For one, the industry has been caught in increasing labor and union challenges, slowly forcing railway companies to increase worker benefits. Secondly, multiple large railways have seen significant derailment events garnered media attention in recent months, notably the East Palestine derailment expected to cost Norfolk Southern (NYSE:NSC) around $387M. The derailment cost is not too high compared to that company’s ~$49B market capitalization. However, the event has had a more significant negative impact on the firm’s public and political perception. It could have downstream consequences for its union battles – which the US executive branch has considerable control over.

Norfolk Southern and its peers are historically popular stocks due to their usually ample stability. Railroads are similar to utility stocks because their semi-monopolistic pricing power and legal framework nearly guarantee their profitability. That said, demand for goods can fluctuate with the economy, leading to cyclical risks for railroads. Additionally, similar to utilities, the growing labor shortage of skilled railway workers has strained working conditions, causing more employees to retire early or demand improved conditions. Norfolk Southern has expanded its conductor training program by orders of magnitude to arrest this crisis. However, the fact remains that over two-thirds of conductors are over forty years old, and just 5% are below 30, implying the labor shortage will expand for some time unless tremendous recruitment progress is made. In my view, this is one of the most significant primary cost risk factors facing Norfolk Southern today.

The US economy is also showing significant signs of a slowdown, led by sharp declines in the manufacturing PMI index. Historically, that is not great news for Norfolk Southern and could decrease gross margin profitability. That said, a business slowdown could also offset the labor shortage. Still, NSC may face a higher risk profile today than it has over most of the past decade, potentially bringing the stock lower over the coming months.

Macro Headwinds Facing Norfolk Southern

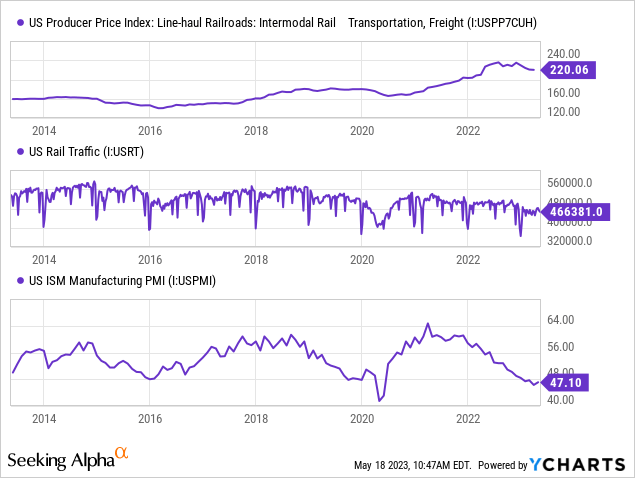

Much of Norfolk Southern’s potential is outside of the company’s control. More important economic factors include changes in US goods production and demand. The most important revenue generators for the company are agriculture and chemicals, making up around a third of its typical sales, with the rest distributed in more cyclical segments (automotive, metals, coal, etc.). Interestingly, total US rail traffic is relatively low today and has declined over the past decade. Changes in rail traffic activity are roughly correlated to the US manufacturing PMI, which predicts changes in total US manufacturing output. The PMI is very low today and signals a more considerable impending decline in rail traffic activity. That said, rail prices are relatively high today and have climbed over recent years despite declining activity. See below:

Rail producer prices have risen significantly since 2020 despite a moderate decline in rail traffic activity. While that may seem odd, it implies a shortage of available rail lines (improving rail pricing power) and shortages within the railroad industry that have increased costs (encouraging railways to increase prices). However, as implied by the contracting PMI, I believe rail traffic volumes will slip much further in 2023, causing rail prices to reverse – as seen in the more recent rail PPI metrics above.

As prices decline, rail costs may continue to increase faster than inflation. In 2022, Norfolk Southern saw wages and benefits rise by 9%, purchased services rise by 10%, and fuel costs increase by 62%. Over the coming year, I suspect wages and other labor-centric expenses will continue to grow at that pace until the labor shortage gap is closed; however, with most energy commodities much cheaper, the company should save on fuel costs.

The labor shortage in railways is tremendous and may be one of the most significant bottlenecks within the broader supply chain. Problematically, the existing shortage (mainly driven by retirements and an age-skewed labor force) has caused existing worker burdens to grow, increasing attrition rates further. We’re seeing this trend in many blue-collar centric industries today where employees leave (and young people avoid seeking employment in) companies with labor shortages because of the associated decrease in working conditions. This situation creates a “vicious spiral” that can lead to ever-rising employee costs until the shortage is finally closed. Of course, this issue can also lead to decreased worker quality, increasing the risk of “safety events,” which can create high one-off costs for the company.

Norfolk Is Unlikely To Sustain Stellar Margins

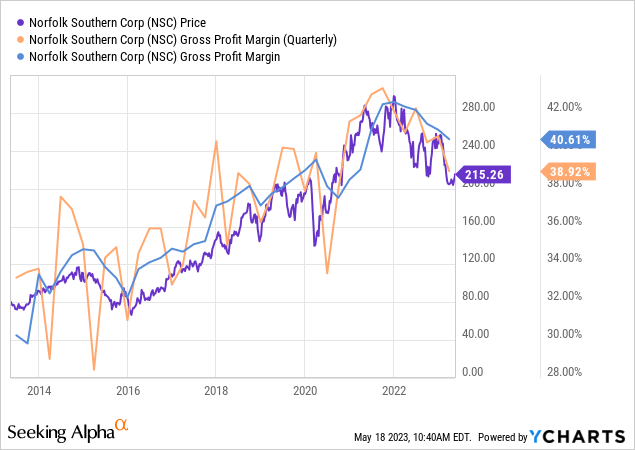

Norfolk’s stock price performance has historically been closely tied to its gross profit margins, which are the primary driver of its total margins. Usually, Norfolk’s net profit margin is around 16-18% lower than its gross margin, so a 38% gross margin reflects a likely 21% net margin. Changes in interest costs, depreciation, top-level salaries, and one-off costs make up the primary difference. Although interest rates are much higher today, Norfolk’s debt maturity schedule is more skewed toward long-dated (7-year plus) debt, with little variable debt, so the rate increase should not soon harm the firm’s margins. That said, the company’s gross margin may slip further from its high levels today:

Norfolk Southern’s gross margin has increased significantly over the past decade by 10% from 2013 to the 2022 peak. However, there has been a material dip in the company’s gross margins since last year, mainly due to a disproportionate increase in fuel and labor costs. That said, compared to its historical record, Norfolk’s margins are very high today, potentially implying the company was too aggressive in reducing costs and underinvesting in labor, technology, and new equipment – leading to its challenges today and increasing costs over the coming years.

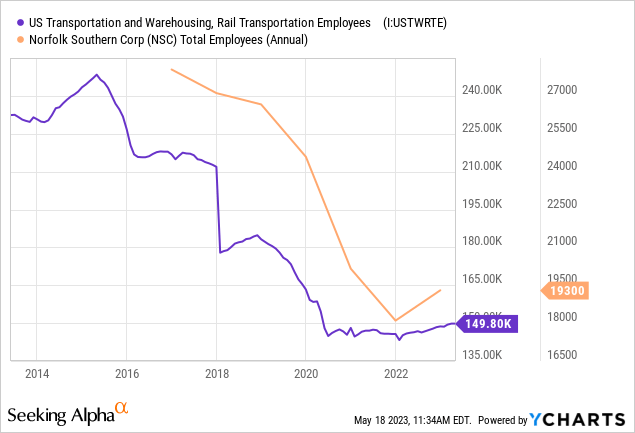

Of course, technological improvements have decreased the need for railway workers; however, the sharp decline since 2018, particularly in 2020, is quite notable. See below:

While the company is making efforts to expand its trainee labor force, it likely has a long way to go and may face headwinds due to the decline in sentiment following the derailment event and the strike ban last year. I believe this situation will inevitably lead to a prolonged and considerable decrease in Norfolk Southern’s gross margins back to the ~30% level as wages and costs grow more quickly as the firm races to fix the crisis. Eventually, the expansion of AI and other technological innovations could alleviate the shortage and improve the company’s margins, but I do not believe we will see such innovations become operable too quickly.

What is NSC Worth Today?

Norfolk Southern’s valuation metrics generally align with most of its peer group, operating at a forward “P/E” of around 16X. However, its valuation metrics are usually 10-20% below its five-year historical average, likely due to increased rates, which lower fair valuations for most companies. While my focus is on Norfolk Southern, there is generally little difference between NSC and most of its peer group, with all struggling with shortages and volatility in rail traffic. From that standpoint, NSC is likely not overvalued nor undervalued compared to its peer group or its typical valuation range.

The current outlook suggests NSC’s revenue and EPS will continue to grow over the coming years. In my view, this is generally unlikely due to the growing negative pressures on the company’s profitability. Although it has had a labor and parts shortage issue since 2020, the unions have become more assertive lately as the issue has expanded and rail demand normalized from the lockdown declines. Looking forward, the declining manufacturing PMI and generally weak consumer data suggest rail traffic volumes will likely fall faster over the coming months. Although that may alleviate the labor shortage to an extent, I believe the company has a long way to go in that regard, as seen in the ~25% decline in its total employee count over recent years. Thus, I believe NSC will see its revenue decline over the coming year while its costs continue to grow, meaning its gross margins might rapidly accelerate lower.

Further, I do not believe its margin will rebound quickly after a potential recession, as it must make long-term changes to attract younger career employees that will likely push its cost structure permanently higher. Indeed, I suspect the significant increase in NSC’s margins over the past ~15 years may have been a naive effort to create “short-term” shareholder value at the expense of long-term stability (i.e., cutting investments in employee training, retention, and maintenance capital expenses). Now, it has no choice but to reverse course, potentially pushing its overall margin back to its pre-2006 norm of ~12-16%. This would translate to an EPS of around $8 at today’s sales or nearly half of TTM levels. It could take years for that to occur. Still, I suspect a recession would greatly accelerate the trend, potentially reducing NSC’s fair value by up to 50%, given its industry’s typical “P/E” levels.

Overall, I am bearish on NSC and believe it will decline further in value over the coming year as investors and analysts better understand the long-term catalysts hampering the company’s profitability. While I suspect its EPS could fall substantially over the long run, the timeline is vague and depends significantly on overall economic activity and its union situation. Thus, I would not bet against the stock since it is not overvalued based on its current EPS level.