Union Pacific: Poor Return Outlook For The Next 5 Years

Investment Thesis

In my opinion, Union Pacific Corporation (NYSE:UNP) offers a complicated investment outlook, riddled with both financial and operational hurdles. The company’s EPS growth, while seemingly impressive, is largely fueled by share buybacks funded through debt, a strategy that has been recently halted. This approach not only artificially boosts EPS but also heightens the company’s financial vulnerabilities, particularly in light of its substantial debt and interest obligations. Complicating matters further are looming inflationary pressures and expected increases in labor costs for the latter half of 2023, which UNP may only be able to partially mitigate through pricing strategies. Additionally, the company is facing a softening demand environment across various sectors, exacerbated by a bleak industrial growth outlook for 2023. If one were to invest in UNP at its current share price of $221.03, we project a 5-year CAGR is a mere 1%, based on our price target of $224.22. Given these factors, we rate Union Pacific Corporation stock a Sell.

Company Overview

Union Pacific Corporation is one of the largest railroad companies in the United States, providing freight transportation services across a network of approximately 32,000 miles. The company plays a crucial role in the American supply chain, transporting goods ranging from agricultural products to industrial machinery. UNP competes with BNSF Railway, a business wholly owned by Berkshire Hathaway (BRK.A, BRK.B).

Reliance on Share Buybacks for Growth

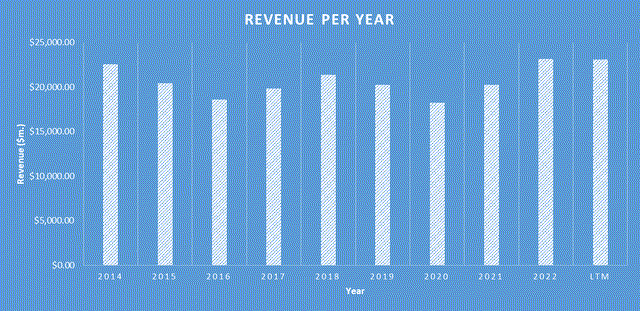

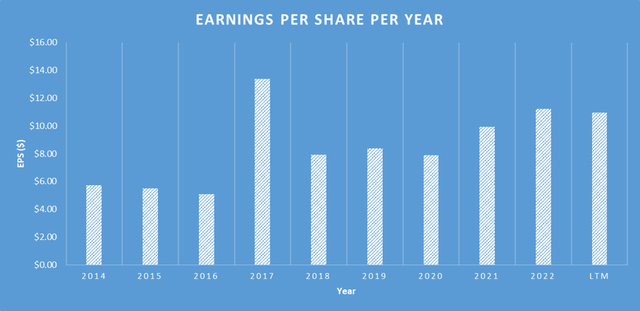

Over the past 5 years, the company has demonstrated flat revenue growth, while steadily growing earnings per share. Its revenue has shown stagnation, increasing from $21.384 billion in 2018 to $23.102 billion in the last 12 months in 2023, representing a compound annual growth rate (CAGR) of approximately 1.5%.

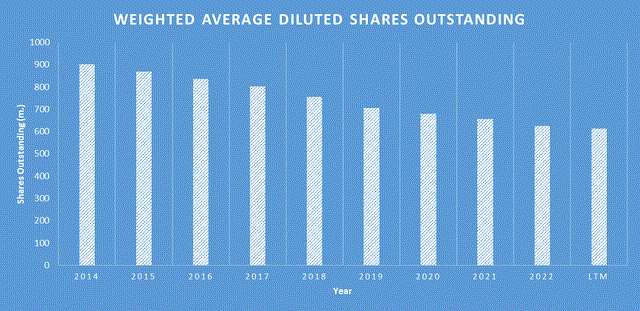

In my opinion, while Union Pacific Corporation has provided an impressive growth in Earnings Per Share, from delivering $7.91 in 2018 to $10.95 in the last twelve months, representing a Compound Annual Growth Rate of about 7%, the underlying story however is more nuanced. A significant portion of this EPS growth, in my view, has been inorganic, fuelled more by share buybacks rather than by organic business expansion. The company has been using debt to fund these buybacks, a strategy that comes with its own set of risks. Leveraging debt to repurchase shares can artificially inflate EPS and shareholder value in the short term, but it also increases the company’s financial risk, particularly in a higher interest rate environment. As interest rates rise, the cost of servicing this debt increases, putting pressure on the company’s cash flows and potentially affecting its ability to invest in growth opportunities or maintain dividends.

It’s worth noting that UNP has paused its share buyback program for the rest of 2023. To me, this signals that the company can no longer maintain the status quo due to the increased cost of capital. This pause could also be a red flag for investors, suggesting that the company might be bracing for financial headwinds. Without the support of share buybacks to boost EPS, and with the added burden of higher interest rates on its debt, UNP may find it challenging, in my opinion, to deliver the kind of shareholder returns that have been seen in the past.

Poor Allocation of Capital

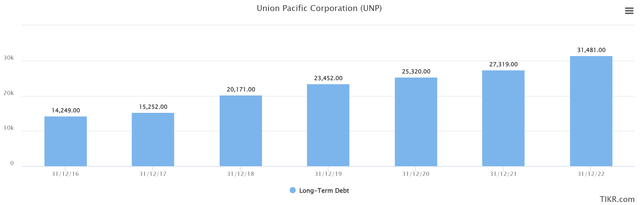

In my opinion, Union Pacific Corporation’s balance sheet raises some concerns, particularly when it comes to its debt load. As of the most recent quarter, the company reported cash and cash equivalents of $830 million, while its total debt stands at a staggering $31.378 billion. This debt load is approximately 6x the company’s current earnings, which is a high level of leverage that could pose risks, especially in a rising interest rate environment. Furthermore, the interest expense over the last twelve months was $1.323 billion, which is about 20% of the company’s current earnings. This sizable interest expense could become a significant burden if earnings were to decline or interest rates were to rise. As we can see below, the debt load year to year has consistently increased as debt has been used to repurchase shares.

Additionally, it’s worth noting that much of the share buybacks have been conducted at a time when, in my view, the company appears to be overvalued. This could mean that the company has been buying back its shares at premium prices, which is not the most efficient use of capital.

Inflationary Pressures

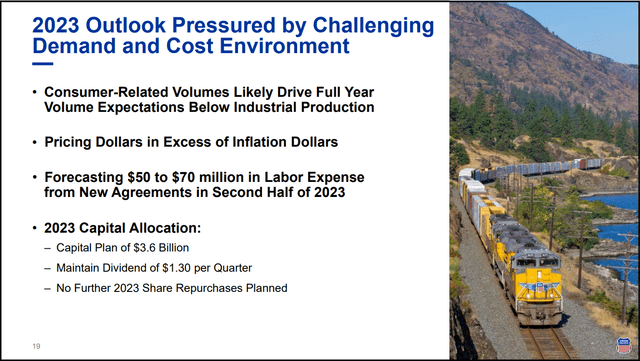

In my opinion, Union Pacific Corporation faces a complex financial landscape, especially in the context of inflationary pressures. The company is forecasting an additional $50 million to $70 million in labor expenses due to new agreements in the second half of 2023. This added cost could put further strain on the company’s operating margins, particularly if inflation continues to rise. However, UNP has also indicated that its pricing dollars are in excess of inflation dollars. This suggests that the company has some ability to pass on increased costs to its customers, potentially mitigating the impact of inflation on its bottom line.

UNP Q2 2023 Earnings Presentation

Still, the ability to price above inflation doesn’t necessarily cover all additional expenses, such as the forecasted increase in labor costs. Moreover, the effectiveness of this pricing strategy could be influenced by market demand, competition, and the overall economic environment. In a high-inflation scenario, companies with significant operational leverage and debt, like UNP, may find it challenging to maintain financial performance. The added labor costs and the need to price above inflation create a delicate balancing act for UNP.

Weakening Demand

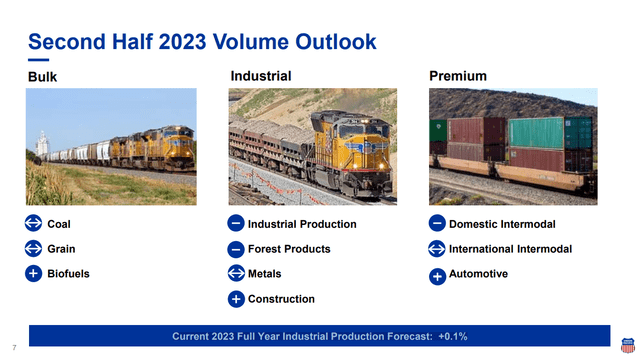

In my opinion, Union Pacific Corporation is facing headwinds from weakening demand across multiple sectors, which could significantly impact its revenue and profitability. As we enter a soft demand environment, several factors are contributing to this downturn. Reduced export potash shipments and weaker beverage imports are affecting the company’s freight volumes. Additionally, low natural gas prices are making this energy source more attractive compared to coal, leading to decreasing coal demand. The weak housing market and reduced demand for corrugated boxes further exacerbate the situation, impacting the company’s ability to maintain freight volumes in these sectors.

UNP Q2 2023 Earnings Presentation

The current 2023 full-year industrial production forecast of just 0.1% growth adds another layer of concern. Such a marginal increase suggests that the broader industrial landscape is not poised for significant growth, which could mean continued soft demand for UNP’s services.

Valuation

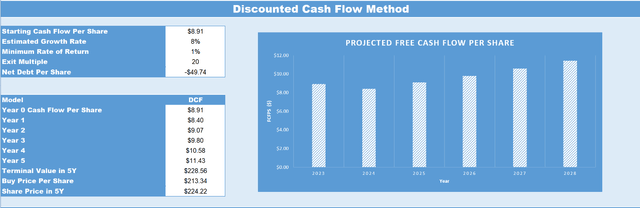

When considering valuation, I always consider what we are paying for the business (the market capitalisation) versus what we are getting (the underlying business fundamentals and future earnings). I believe a reliable way of measuring what you get versus what you pay is by conducting a discounted cash flow analysis of the business as seen below.

UNP’s current TTM cash flow per share as of Q2, 2023 is $8.91. Based on inflationary pressure, the weakening macroeconomic environment, and the pause in the share buyback program, I believe that UNP’s TTM cash flow per share will decrease in 2023 to $8.40. From 2024 to 2028, I expect UNP to grow at 8% annually. Therefore, once factoring in the growth rate by Q2 2028 UNP’s TTM cash flow per share is expected to be $11.43. If we then apply an exit multiple of 20, which is based on UNP’s mean price to free cash flow ratio for the previous 5 years, this infers a price target in five years of $224.22. Therefore, based on this estimation, investors buying UNP at today’s share price of $221.03, would earn only a CAGR of 1% over the next five years.

Conclusion

Union Pacific Corporation presents a complex investment picture marked by several financial and operational challenges. While the company has shown EPS growth, this appears to be largely inorganic, driven by debt-funded share buybacks that have now been paused. This strategy has not only inflated the EPS but also increased the company’s financial risk, especially given the high levels of debt and interest expenses. Adding to the complexity are inflationary pressures and anticipated labor cost increases, which UNP may only partially offset through pricing above inflation. The company is also grappling with weakening demand across multiple sectors, further clouded by a minimal industrial growth forecast for 2023. We project only a 1% 5-year CAGR based on our price target of $224.22.